GenAI Workflow Factory for BFSI Enterprises

Dramatically reduce OPEX via ready-made, customisable GenAI workflows for onboarding, claims, credit, and collections

AI Agents: From Sourcing to Decision

We’ve built AI tools that take the guesswork, paperwork, and legwork out of lending — so your credit process runs faster, smarter, and with fewer drop-offs.

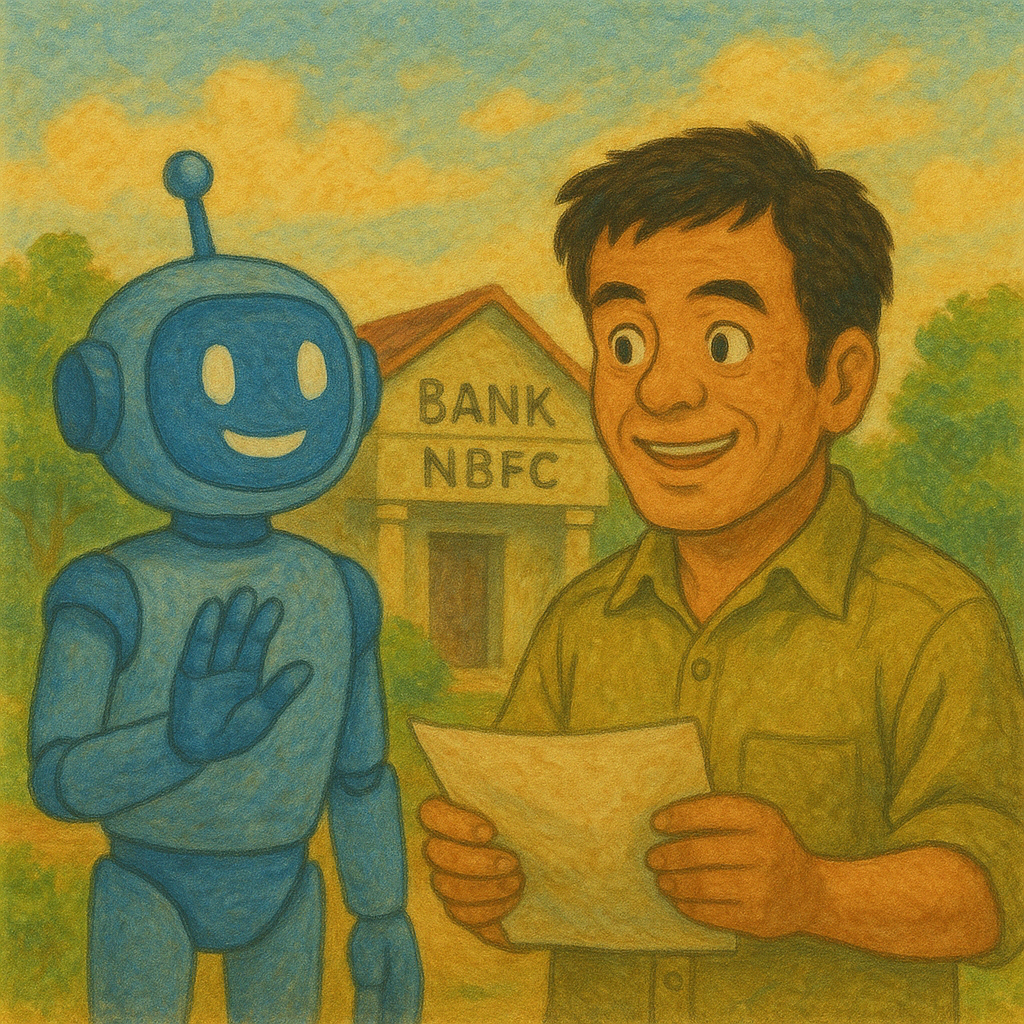

AI-Powered Field Credit Assessment

Carry AI Agents into the field. Records conversations in Indian languages. AI will guide your agent to ask relevant questions, take photos and documents.

Learn MoreHow are Lenders Leveraging AbleCredit's AI

AI Solutions for All Workflows in a Lending Org

From application to approval, our AI-powered platform streamlines every step of the credit process. Built for scale, designed for efficiency.

Get Started

AbleCredit has transformed our credit evaluation process, reducing processing time and costs, while improving accuracy.

Ramdas Acharya

Chief Credit Officer, Clix Capital

Resources & Case Studies

Trusted by Industry Leaders

Our commitment to security, compliance, and excellence is recognized by leading industry standards and certifications.

ISO 27001 Certified

Incubated at NSRCEL, IIMB

Elets- GenAI in Fintech Award 2025

Flexible Data Policy

RBI Audit Ready at all Times

Trusted by top Banks and NBFCs

Highest Grade Encryption of all Data